30 Sep

Think of a situation when you believed in something and tried your best to make it happen, but unfortunately, things didn’t happen according to plan. The same things can happen with investors. When investors do not get the monetary return they expected from their investment, and at the same time, their equity decreases; this situation is called negative shareholders’ equity.

If you are looking for all the information about Negative Shareholder’s Equity, how it happens, and how to avoid it. This place is just right for you to get all that information.

Table of Contents

What is Shareholders’ Equity?

Before explaining negative shareholder’s equity, you first need to understand shareholder’s equity. The financial health of any company is determined by the value of equity it owns. Shareholders equity is the amount repaid to shareholders after offsetting all debts in the case the company liquidates its assets. Shareholders’ equity is the amount owners invest in a business. The equity includes the amount investors directly invested and accumulated reserves earned from that business which were reinvested. It is an essential indicator of businesses’ financial stability and the owners’ attitude towards their business. It appears on the balance sheet of the company.

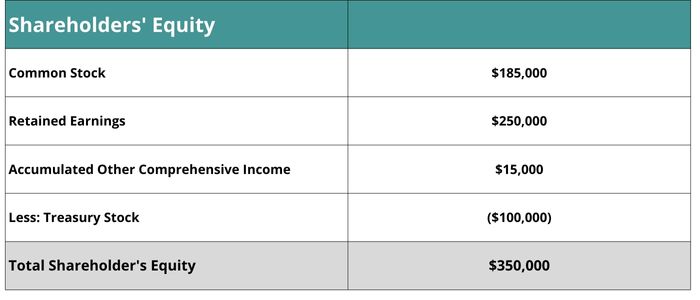

For example, below is the shareholder’s equity from the balance sheet of ABC company.

Calculating shareholder’s equity

Shareholders’ equity can be calculated by using the accounting equation, which is as follows,

Assets = liabilities + shareholder’s equity

To calculate shareholders’ equity, we will reformulate the accounting equation,

Shareholders’ equity= assets – liabilities

Alternatively, you can also calculate shareholder’s equity by adding common stock, retaining earnings, accumulated income, and subtracting treasury stock.

Shareholder’s equity = common stock + retained earning + accumulated other comprehensive income – treasury stock.

Negative Shareholder’s Equity

Negative shareholders’ equity happens when the liabilities of a company exceed its assets. It represents the net worth of a company. If negative shareholder equity persists for an extended period, it can harm the business. In this case, the business may find itself in a situation where it is unable to pay dividends to its shareholders, losing existing investors. Also, the corporation will encounter numerous challenges while taking on new debts and loans.

Example of negative shareholder’s equity

Below is the balance sheet of ABC company in which the value of assets and liabilities are mentioned.

Assets | |

Current assets | $89,000 |

Investments | $1,000 |

Property , plants and equipment | $20,000 |

Total assets | $110,000 |

Liabilities | |

Current liabilities | $240,000 |

Long-term liabilities | $45,000 |

Total liabilities | $258,000 |

To find shareholders’ equity, we will use the accounting equation.

Shareholders’ equity = assets – liabilities

SE= $110,000 – $258,000

SE=-$148,000

The shareholders’ equity for company ABC is -$148,000. The negative sign indicates the negative shareholders’ equity. In this case, the company’s liabilities exceed the assets; therefore, shareholder equity is negative.

Reasons for negative shareholders’ equity

Long-term losses: If the company faces losses for a more extended period, it results in cash outflow, which ultimately causes negative equity.

Exceed dividends: When dividends exceed the accumulated income, the company pays dividends in cash from the profits gained by the company and is left with negative equity.

Purchase other shares: The company has bought shares from other shareholders from the amount of the company’s cash and retained earnings.

Liabilities exceed assets: If the amount of liabilities exceeds the number of assets, it results in negative equity. This may happen when a company faces losses and takes debt to overcome its losses.

Treasury stock repurchase: The reduction in equity happens when a company decides to repurchase its common stocks. Negative shareholder equity may result from the repurchase of substantial volumes of common stock.

Conclusion

Negative shareholder’s equity occurs when there are more liabilities than assets. It is a very serious situation that can arise when there are costs that a company cannot pay in cash. If the company cannot pay its creditors fully, they go into debt. This increase of debt over profits is termed Negative shareholders equity.

In summary, negative shareholders’ equity is a poor signal for investors. As a result, investors usually ignore unhealthy companies with negative shareholders’ equity.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan