20 Jul

A business can raise capital on the capital market by issuing shares, bonds, debentures, and other financial instruments. While the secondary markets deal with already-issued equities, primary market is where these securities are first produced. You will learn more about secondary markets in this article

Table of Contents

What is the Secondary Market?

The secondary market is a marketplace in which investors can buy and sell securities from one another. It’s also known as the aftermarket. It is the financial market where companies purchase and trade securities like stock, bonds, options, and futures that a company issue already. Secondary markets include the national exchanges, such as the NASDAQ, New York Stock Exchange (NYSE), and London Stock Exchange (LSE).

The secondary market is where investors make money. It offers continuous daily trading and often provides access to lower-priced shares than those available through direct purchases on exchanges or over-the-counter markets. In secondary markets, the fair price of shares is maintained based on the equilibrium of supply and demand. In addition, the secondary markets aid in maintaining the fair pricing of securities. Therefore, no agent may impact the share price.

How Does the Secondary Market Work?

The secondary market is a vital part of the financial system, providing liquidity to investors and helping companies raise capital. Markets for securities allow investors to buy and sell their investments without having to transact directly with each other.

A secondary market is a place where people who want to buy and sell securities, shares, bonds, etc., can go. Instead of going out into the world looking for someone who has something you want, you ask around until somebody knows someone else who does, and then you trade. That’s how this market works. People go out into their communities looking for what they need; when they find it in another community (a third party), there’s no reason why those two markets can’t connect!

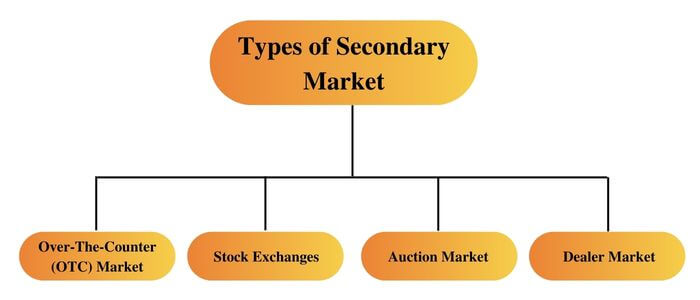

Types of Secondary Market

Over-The-Counter or OTC Market

Investors transact among themselves in these decentralized markets. In these markets, there is a lot of severe competition among investors, which causes pricing to vary from supplier to supplier. In addition, unlike exchanges, the risk is more significant because sellers and buyers engage directly with one another. One example of an OTC market is the foreign exchange market.

Stock Exchanges

Stock exchange is a platform where businesses trade securities without direct interaction between buyer and seller. In this market stock exchange act as a guarantor. That is why the risk is almost zero. For example, National Stock Exchange (NSE) and The Bombay Stock Exchange (BSE) are platforms. In this market, brokers conduct transactions and collaborate with market makers to give institutions and individual investors bids and ask prices.

Auction Market

This kind of secondary market provides a venue for buyers and sellers to interact and declare the price at which they wish to exchange shares. In this market, both buyers and sellers simultaneously submit competitive bids. The buyer announce maximum price at which he is willing to purchase a security, and the seller announce minimum price at which he is willing to sell. Buyers and sellers rarely engage in direct discussions. Instead, for a charge, brokers match buyers and sellers with appropriate bids.

Dealer Market

Electronic platforms like fax machines and phones make transactions easier in this kind of industry. The cost at which buyers are willing to buy or sell a security are available to the public in dealer markets. Investors who agree to that pricing can communicate with the dealer directly without a broker.

Secondary Market Instruments

The instruments that can be traded in the aftermarket can be broadly divided into three groups:

Fixed Income Instruments

Debt instruments make up most of the fixed-income assets. They ensure consistent and regular payments, such as interest and principal payments upon maturity. They consist of bonds, preference shares, and debentures.

Variable Income Instruments

Investments in these securities do not ensure a steady, predictable income. Instead, the rewards fluctuate according to market changes. High risk and potential return are both associated with the investment made in this situation. Returns are produced in accordance with risk and reward considerations. Equity and derivatives are a couple of examples of variable income instruments.

Hybrid Instruments

Convertible debentures are hybrid financial instruments that may be converted into equity shares after a specified time period. This kind of security can offer your portfolio several advantages and is offers a debt or loan securities.

Advantages of Secondary Market

- Aftermarkets make it simple for investors to sell their holdings and turn them into cash when needed, thus increasing the liquidity. It offers the advantage of short-term liquidity as well as medium-term investments.

- The secondary market is an excellent method to assess a nation’s overall economic health.

- Using secondary market valuation data, investors can estimate how much they have invested in their securities. As a result, it is helpful for financial activities like borrowing money from a bank or tax calculations.

- Selling their shares on a secondary market is one way for investors to receive the money they require. These valued securities, ideal for investors with limited liquidity, are always available for purchase.

- Investors can mobilize their funds more quickly and conveniently with the help of securities. Securities are a crucial investing tool that facilitates faster money mobilization without sacrificing safety or risk-taking.

- In secondary markets, the fair price of shares is maintained based on the equilibrium of supply and demand.

Limitations of secondary Market

- The secondary market prices of securities are highly volatile. For investors, price changes may result in unforeseen or unexpected losses.

- In a secondary market, buying and selling can take some time. Before finalizing contracts, investors must deal with time-consuming documentation.

- The investments made in a secondary capital market are susceptible to a high degree of external risk due to the influence of numerous external factors. These might cause investors’ current valuations to change in seconds drastically.

- Because brokerage commissions are taxed each time a deal is completed, investors need to exercise caution while using them. If you’re not careful, commissions could potentially reduce your profit margin. Commissions can have a significant impact on investors.

Primary vs. Secondary Market

Conclusion

The secondary market is a marketplace, apart from the primary market, in which investors can buy and sell securities from one another. While most modern stock markets are more like an auction that takes place over two days – one day to buy shares, another to sell them – the secondary market offers continuous trading throughout each day, and it is where investors make money.

Marjina Muskaan has over 5+ years of experience writing about finance, accounting, and enterprise topics. She was previously a senior writer at Invyce.com, where she created engaging and informative content that made complex financial concepts easy to understand.

Related Post

Copyright © 2024 – Powered by uConnect

Marjina Muskaan