23 Jul

A debt instrument is a tool used by a government, business, and individual entity to raise capital for long-term growth, investment, and future planning. It is a fixed-income asset that allows lenders to earn a fixed interest on it, and the issuer can use it to raise funds at a cost. Debt is a legal obligation on the issuer to repay the capital along with interest to the lender in a timely. Debt instruments include details about the interest rate, the interest payment date, and the maturity timeframe.

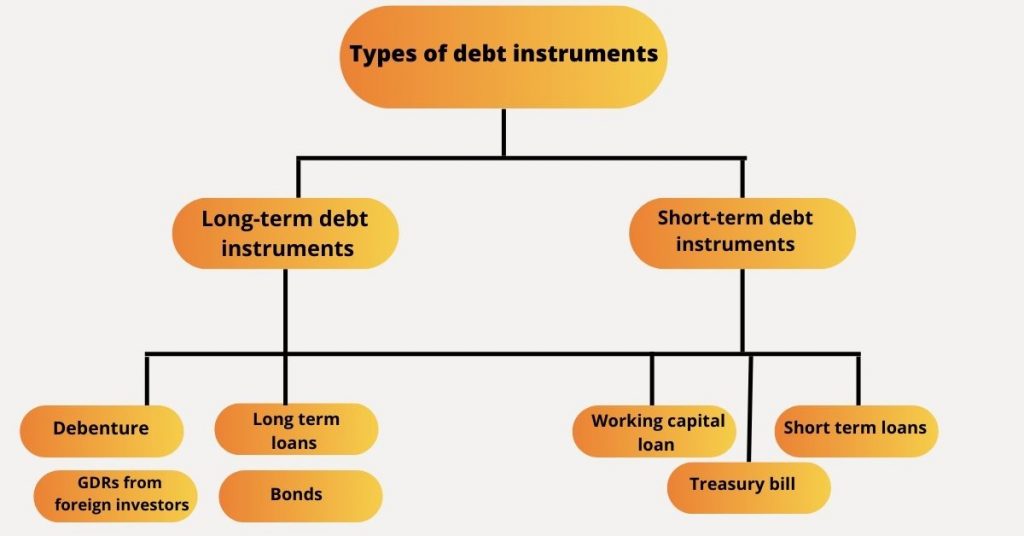

Types of Debt instrument

The common types of debt instruments are as under:

Long term instrument

A company uses the types of instruments for long-term growth that helps the company in the long run. Long-term instruments include bonds, debenture, long-term loans, and GDRs from foreign investors. Loans term debt instruments hold a charge on companies’ assets. Such types of instrument financing are more than five years. Examples are as follows:

Debenture

A debenture is an investment issued by a business and organization to raise money for long-term growth and development. It is an agreement between the borrower and lender. The company borrows money from a lender at a fixed rate of interest called debenture interest, and the person holding the debenture is called the debenture holder.

Long term loans

The financing method used by a company to get loans from banks and financial institutions. This financing method is not considered favorable because of too high-interest rates.

GDRs from foreign investors

The Global depository receipt( GDRs) method raises capital in local, international, and US markets. It is a certificate issued by a bank representing shares in foreign stock on two or more global markets.

Bonds

Bond is like debenture, but bonds are used in banks and large companies. Municipalities, states, and sovereign governments finance projects and operations.

Medium and Short term instrument

A company uses these types of loans for its day-to-day activities. The period of financing for such an instrument is 2-5 years. Short-term loans do not hold claim over companies’ assets and have low-interest rates. Short-term debt instruments include working capital loans and short-term loans from financial instruments. Examples are as under:

Working capital loan

A company uses a working capital loan for its day-to-day activities like payment of rent, creditors outstanding, purchase of raw material,s and repair of machinery.

Short term loans

A short-term loan is a type of loan obtained to support a temporary company’s needs. The period of fund transfer is less than 5 years. Although they do not charge interest monthly, they have a fixed interest rate.

Treasury bill

A Treasury bill (T-bill) or non-competitive bidding process is a short-term debt obligation with one year of maturity period. Treasury bills are redeemed on full maturity at par value, but they can sell at a discount price if sell before maturity.

Advantages of debt instrument

- The company does not lose its ownership to the new shareholders as the debenture does not form part of the share capital.

- A fund that can be raised from a debt instrument is easier than equity funding.

- Long-term debt instruments keep the company running smoothly and profitably year around.

- Debt financing helps companies to plan well in advance regarding cash flow/fund flow status.

- Companies benefit from interest deduction from the profit before calculating tax liability.

Disadvantages of debt instrument

- Once funds are raised from debt instruments, they are to be repaid on maturity.

- In debt financing, the company must pay interest and a principal amount to keep the cash flow for making payments in time.

- Interest payments reduce the company’s profit by a significant amount.

Conclusion

Summing up the above article, we have discussed the debt instrument, types, advantages, and disadvantages. A debt instrument tool is an entity to raise capital. Moreover, the types of debt instruments are long and short-term instruments.

Shabana has been a committed content writer and strategist for over a 5 years. With a focus on SaaS products, she excels in crafting compelling and informative content.

Related Post

Copyright © 2024 – Powered by uConnect

Shabana