16 Jun

A single-entry system (also known as a cash basis accounting) involves recording transactions when the money is paid instead of when they occur. In an accounting system, a single entry system can’t keep track of accounts receivables, payables, and inventory.

What is a Single-Entry System?

A single-entry system is the simplest form of bookkeeping. It does not follow any rules or conventions. Small business entities use them with no statutory requirements for preparing financial statements.

This bookkeeping system is very simple, as every accounting transaction involves only one entry to record it. As a result, this is an easy-to-use, easy-to-maintain system that small businesses and individuals use efficiently who want to keep their records up to date with minimum effort.

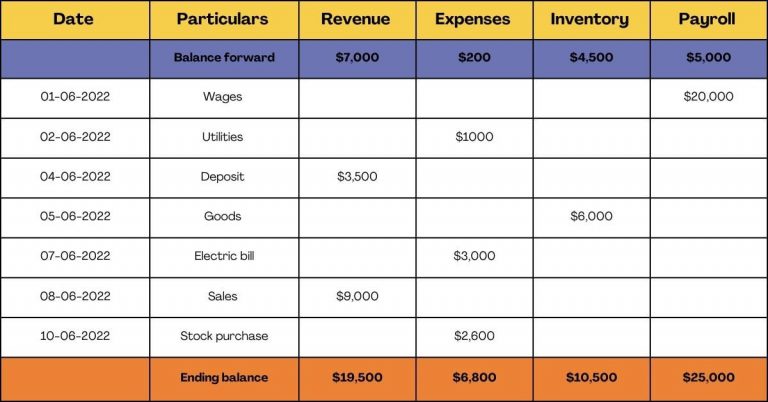

Example

Let’s illustrate the single-entry system with the help of a simple example.

John’s Books and Stationery Store is a single trader who runs a small stationery store in New York. He recorded the transactions for the last week, beginning from 1st June 2022 to 10th June 2022, in his journal as follows:-

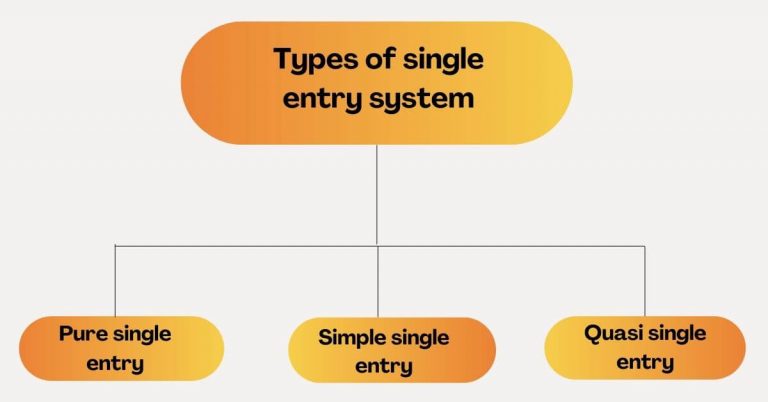

Types of Single-Entry System

Pure single entry

Pure single entry is a method of accounting in which businesses only records personal accounts i.e. real and nominal accounts are ignored. However, businesses don’t use this practice, as it does not ensure that transactions are correctly matched.

Simple single entry

- Simple-single entry is the simplest type of accounting system.

- It is simple because it is easy to understand and use.

- This system is a cash-based, relatively uncomplicated method of recording transactions in a manual fashion.

- it only records transactions related to personal and cash accounts.

Small businesses and non-profit organizations that rely on a single set of books to record all financial transactions use this accounting system. In addition, any member within the organization can access the information who may also need access to specialized accounts (e.g., payroll) or other data points from other sources (e.g., bank statements).

Quasi single entry

Quasi-single entry is a type of simple, pure, and complex single entry system. The main difference between quasi-single entry and other simple systems is that you can’t create new items in the account without creating an invoice for them.

It offers many benefits over its counterparts by allowing companies to track all transactions from one central location. However, the downside to using this method is that it requires more time than other systems because you must manually create individual invoices for each item you sell or buy.

Who Maintains a Single-Entry System?

A personal business entity, such as a sole trader or partnership, maintains the single entry system. Businesses such as companies and non-profit organizations can also use this system. Moreover, government agencies that operate on a small scale and do not need complex accounting system also use single entry system of accounting.

Advantages of Single-Entry System

- A single-entry system is an accounting method that is easy to understand and use.

- A small business or even a single trader can use this system.

- It involves only one book in which all transactions are recorded and maintained.

- In this system, every transaction is recorded once only in the books of accounts. This means that no matter how often you post the same transaction in different books of accounts, it will not be accounted for again and again.

- A single entry system does not require special training or user experience. Anyone with basic accounting knowledge can easily understand this type of accounting method.

- All transactions are recorded in a single-entry account book that can be used as evidence.

- We record only one entry for each transaction under the single entry system, saving business time.

- It provides the manager with basic information about sales and profit to make informed decisions.

Disadvantages of Single-Entry System

- The single-entry system is unsuitable for large-scale businesses.

- It cannot handle complex accounting, multi-level accounting, and multi-currency.

- The accuracy of the account is low in this system because we only record one aspect of the transactions.

- By preparing a trial balance at the end of the specified time therefore, it is impossible to verify the mathematical accuracy of the account.

- There is no option of cross-checking as opposed to a double-entry system. Therefore, many calculation errors can occur.

Conclusion

A single-entry system is a simple form of bookkeeping used by small businesses. This method of accounting requires only one entry for every transaction and does not provide detailed financial reports. The single-entry system is suitable for sole small traders, freelancers, and partnerships with few transactions to record.

Content writer at Invyce.com

Related Post

Copyright © 2024 – Powered by uConnect

Meena Khan